Our posts are now reported on

the highly regarded FXStreet.com.

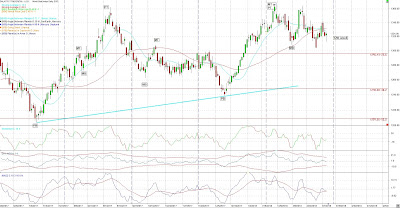

SP500

The last Primary cycle low was August 21st, the day of the

Total Solar Eclipse. The standard for the Primary cycle is 18 weeks. We appeared to have put in the Primary cycle trough on February 9th at a low of

2532.69. This was late at the 23th week but

this may be distorted as there are other longer-term cycles due. This may have

been the 9-month cycle trough as well. Longer term cycles may push the Primary

cycle further out.

The SP500 Primary cycle has a

range from 15 to 23 weeks so we were

at the limit. The high for this Primary cycle was 2872.87 on January 26th. The high for the COMPQX was Friday March 9th as of this writing.

This puts us 4 weeks along in a new Primary cycle. We

often get a short pull back in the 2nd to 3rd week at the

start of a new Primary cycle. We may have just seen that pull back, remembering

the longer-term cycles may push the Primary cycle out further.

Also, when the markets have a

big down move, like we’ve seen, it will often go back and test the low again.

Either a little above or below. I suspect we will test the recent low either early or late March 2018. For example,

March 1st and 2nd we had Venus trine Jupiter then Mercury trine

Jupiter. Jupiter is often recognized as optimistic, positive and prone to

exaggeration. It can also represent that which has been overdone, and in the

markets a move down to correct an exaggerated move.

This coming week will see:

Mar 11 Mars trine Uranus

Sudden, excitable events. Acts of

violence.

Mar 13 Sun trine Jupiter

In this case, a hindrance to

success. Lost position

This time frame is affected by a number of Jupiter signatures.

This time frame is affected by a number of Jupiter signatures.

Mar 13 Venus square Saturn

Passing affection. Difficulty with

money.

Mar 14 Jupiter semi-square (45 degrees) Saturn

Inconsistent success, business friction or difficulties.

Separation from a person. Change of residence.

Mar 17 Mars enters Capricorn.

The last two weeks of March has

challenging aspects from the FED natal chart to the current transits to that

FED chart.

The 15 day sma on the SP500

chart is moving up but still below the 45 day sma which is also rising. If we

count back 15 td’s we see that price was lower than the current price, so when

it is dropped the 15 day sma should move up. Similarly, when the day 45 days

ago, if it is dropped it should have the effect of rising. Watch price action

to see if price can break through the next Fibonacci level at 23.6%. If yes it

may be headed to a new high. The Nasdaq put in a new high on Friday. This being

the 4th week of a new Primary cycle indicates a bullish move. We may

start seeing some resistance to a bullish move when we get to Tuesday /

Wednesday.

Some of the cycles that are

coming due are:

- The

Primary Cycle (nominal 18 week) on Feb 9th.

- 9

month cycle

- 5

week.

These are all coming due. See

the charts below

The Primary Cycles

The week of Feb 4 had Pluto conjunct the

heliocentric nodes of Pluto which should give Pluto more power. This was

exact on Feb. 8th, 2018.

This moves very slowly and I think the

cause of the move down. The last time it occurred was Feb 20, 1772 just before 1776. This needs a broad orb +- weeks.

There were a number of other factors pointing to a move down but Pluto conjunct the heliocentric nodes of

Pluto seems most precise. For big moves there are usually multiple Astrological

aspects and / or events.

Pluto stands for major change,

breakdown and regeneration. Pluto can also stand for political breakdown,

organized crime and secret intelligence. We have seen all the above in the US.

Pluto also rules banking systems, stock and shares, manipulation and

corruption. It was due. It could also be the source of the long move up. This

Pluto aspect will be exact two more times in 2018. I will bring them up as we

get closer after Pluto’s retrograde motion.

So we may see some sudden event

early in the week indicating something has been overdone.

The 9 month cycle

The above chart shows the 9

month or 39 week cycle (blue vertical lines). It is due and it was late but appears

to be forming last week. The 20 week cycle was added as well (red vertical

lines)

The 3.8 – 4 Year

The above weekly chart of the

SP500 shows the synodic cycle for Mars

and Vesta. The red circles are the conjunction of the two and the green

double arrows are the middle of the cycle. These are the heliocentric aspects

(Sun centered).

Note how the conjunction is

often at a top with a quick decline. The next Mars / Vesta conjunction is April 25,

2018.

From the last few posts:

“This coming year could see an

increase in geophysical activity, both earthquakes and volcanos.”

Following are the significant

earthquakes (> 6.0) so far in January 2018.

Jan 23 Alaska 7.9

Jan 10 Honduras 7.5

Jan 14 Peru 7.1

Jan 19 Mexico 6.3

Jan 21 Chile 6.3

Jan 25 Russia 6.2

Feb 16 Mexico 7.2

Feb 25 Papua New Guinea 7.5

There has been a number of

volcano’s erupting as well.

On a longer term basis the

following monthly chart of the DJIA

shows the 15 year cycle (red

vertical lines) and the 45 year cycle

(blue lines). The 15 year is due now,

the 45 year due in Sept 2019.

The markets may be volatile into

March. In particular the end of March has significant transits concerning the

FED. See the chart below. Both Venus and Uranus in the 10th will

square Neptune in the 1st. More deception, uncertainty and illusion.

The middle wheel is the Nata chart for the FED and the outer wheel the

transiting planets. This could affect currencies, US$ and / or rates.

In May Uranus will enter Taurus. Look for financial or banking system

problems or changes. Uranus will go retrograde and then move backward into

Aries before Uranus enters Taurus for good. This may also be a problem in currencies.

Generally speaking the first

couple of months of 2018 should be volatile. There are 2 Super Moons and 2

Eclipses.

The above combination, with

Saturn, could be defining problems / restrictions for the general population,

particularly the mature population (pensions?) and with the Sun could affect

the President or other leaders. This combination could affect a number of years

in the future as Saturn is in a sign for approx. 2 ½ years. Other conditions

this may highlight are State funerals, public sorrow and disappointment in

general. State assets could be affected as well as industries connected to

metals and mining.

The following monthly chart of the DJIA shows when Saturn has been

in Capricorn (red x’s). Notice they have all had significant drops.

There could be some type of

surprise coming in 2018 from the government or exposing something from the

past. There could also be a major breakdown in world affairs or leaders.

The following daily chart of the SP500 shows the

Jupiter price line (blue) and the Sun/Earth price line (green). Both of these

price lines have a history of providing support and resistance.

When the two lines cross we often see a big range

day or reversal. Note how price went down and stopped on the Sun / Earth Price

Line. Price touched the Sun (thick blue) price line today but finished close to

the next

The blue horizontal lines are the Jupiter price

line. The thicker blue line just above price may act as solid resistance to any

move up in price. The two lines will doss again on March 13 which is a trine

between the Sun and Jupiter. This signature would typically be indicating a

positive mood in the market but remember, Jupiter can stand for something that

is overdone.

The month of March is open to high drama with

possible major surprises out of Washington DC.

I continue to watch the 24th harmonic cycle (360 / 24) cycles for

short term turns. The brown squares are Sun / Saturn 24 degrees on the

following daily chart. The blue vertical lines are 24 cd’s (calendar days).

The next hit is March 29, 2018 and May 14, 2018 I have added 3 price lines to this chart.

-

Saturn – black

-

Uranus – purple

-

Neptune - light blue

Note the date, Feb 9th, 2018 was the day of the low and a big range

day.

These price lines can act as support / resistance. It

has been at highs and lows. Note also when they cross often gets a reaction in

price on a short-term basis. Also note, near the top of the chart is a light blue

line. This is the Neptune Price Line. Note how it has been strong resistance to

price but has broken through. It should act as strong support when the market

turns down.

Gold

Gold started a new

Primary cycle on December 12. We are

entering the 12th week of a new

Primary cycle. December 12 was close to the Mars entering Scorpio mentioned a

few weeks ago.

Gold

has been moving up as the US$ has moved down. It is important for Gold to stay

above 1309.

We

have seen the crest of the nominal 6-week cycle on January 25th and then

a nominal 6 week cycle trough. To

continue up, Gold needs to move above the Jan 25 high. March 12th or

early in the week may be a critical time for precious metals.

Price

is below the 45 sma and the 15 day sma. The 15 sma is curling over while the 45

day sma is moving up. This looks like Gold is trying to turn down.

The following chart shows

seasonal tendencies for Gold. The 2nd half of the year, on average, is up.

The longer term.7.4 Year cycle

is shown in the following weekly chart. Note we are still early in the latest 7.4

year cycle.

The following chart shows a 27 cd (calendar day) cycle (blue

vertical lines). The next being March 13,

2018. The Moon takes 27 days to

orbit the Earth and the Sun takes 27 days to revolve once at the Sun’s equator.

The red lines headed up are the Mars price lines. We went through the

Mars price line. Moving below the dark red Mars price line was bearish now we

need to move above the Mars price line. It may hit resistance. Price went

through the next Mars price line and is sitting on it.

Looking at this whole chart it

is based on a 24 harmonic. If you count each line from one darker red line to

the next you will find there are 15 of them. 15 * 24 degrees = 360 degrees. Note

price went down to Dec 12 where it bounced off a Mars Price Line.

The following daily chart of

Gold shows the days Mars is entering a new sign (red squares). Look at this

using +- 3 td’s (trading days). The last

date was Jan 26th. These can be at highs or lows. Dec 8 was Mars entering

Scorpio the sign that it rules. Note on

the chart, Mars changing signs, to any sign, often has a change in trend in

Gold price. The blue circles highlight when Mars enters Scorpio, the sign that

it rules. The last red circle shows Mars entering Sagittarius on January 26th. The next sign is

Mars entering Capricorn on March 17th.

Expect a change in trend.

Crude

We were looking at October 6th

as being the trough of the previous Primary

cycle. The new Primary cycle started on February 9th. (see my note above on extending the

Primary cycles). We are 4 weeks along,

remembering we often get a pullback near the 1st 2 – 3 week period of a New

Primary. Crude price has moved below the 45 day sma and the 15 day sma.

It is quite possible we make

another low or at least attempt a low. Neptune

rules Pisces, the sign it is currently in and Jupiter is the co-ruler. The week

of March 12 has the Sun in trine with Jupiter just after it

turned retrograde and thus appears slower than usual These signatures may affect

the price of crude and / or NatGas.

The horizontal blue lines on the

chart below are the average longitude of

the planets Jupiter, Saturn, Uranus, Neptune and Pluto (blue). Note how

price stopped on August 1 and August 31,

right on the average longitude. See it again on Sept 14 and now Jan 16, 2018 which was also a 27 td

(trading day’s). Now the last two days have got support at the blue planet

average line as well. Monday / Tuesday should be important for Crude.

The horizontal red lines are the

Fibonacci retracement from Nov 14, 2016 to Feb 21, 2017.

Watch the red Fibonacci

retracement lines and the blue planetary averages. Crude price is currently moving

down and may have reversed on March 9. I

had expected some resistance at this level. The next level is currently at 64.68.

On the following daily chart of

crude note the green lines sloping up. This is the price line for the

Sun/Earth. The blue lines moving horizontal is the Pluto price line (blue). The

Pluto price line acted as support on March 1st and 2nd

and again on March 9th, although on March 9th crude

made a strong move during the day.

Note how price often follows the

Sun price line up and often stops and reverses at the Pluto price line. We

often get big range days when the two lines cross, like October 27th.and

Nov 22. The next day they cross was February 27th

Watch March 23rd where the Sun

price line crosses the Pluto price line. We often see a big range day or a

change in trend.

No comments:

Post a Comment