- Our first half 2017

forecast dates are available

- Subscriptions include the forecast dates and a monthly Market letter with

- Subscriptions include the forecast dates and a monthly Market letter with

eMail alerts for imminent trading opportunities

-We do not use negative option billing nor do we sell email addresses

-We do not use negative option billing nor do we sell email addresses

Our posts are now reported on the

highly regarded FXStreet.com.

The next 1/2 year Forecast Dates are available

for purchase.

(January,

1 2017 - June 30, 2017)

Subscribers

receive 6 months forecast no matter when they sign up.

Once again,

this post is a little shorter as we work on the June subscribers report.

It will

cover the first week of June.

SP500

For the SP500, cycle-wise I’m looking at March 27th as the Primary cycle

trough and April 13th as a double bottom.

This puts us entering the 11th week of a new Primary cycle. Instead of a nominal 6

week cycle I’m looking at the other possibility which would be a ½ Primary cycle (9 ½ week) cycle high.

From last months

subscriber letter.

“I’m looking at two

possible paths going forward.

1.) A low in April, then a bounce and then down

into June / early- July.

2.) Down in April which continues down into June

/ July”

Option 1 seems to

be unfolding with the low in April 13th and now new all-time highs

and looking for a turn.

Jupiter turned Direct

late on June 9th. This has a history of market turns.

This coming week we have Neptune going retrograde on June 16th. For tops, which

is where we are, Neptune retrograde often has a double top within in 10 td’s of

the aspect.

The day before we have the Sun opposition Saturn which also

has a history of turns and this would be a turn down signal. It needs a broad

orb.

Note the 15 (red) sma and 45 day (blue) sma are both below

price but curling up.

The US markets going up for so long with no pull back is unusual.

It should be noted that in the first 5 months of 2017

Central Bank buying has been approximately 1.5 trillion dollars. This is not

just the FED in the USA but all Central Banks.

Annualized that would equal 3.6 trillion if it continues

which would be a world record.

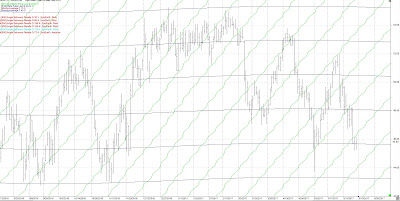

We had a descending triangle (green) on the chart. As often

happens price crashed through the upper line of the triangle, in effect gapping

twice. Those gap areas may act as support. Note price moved down and bounced

close to where the arms of the descending triangle met.

I’m expecting volatility with both ups and downs but moving

forward I’m looking for a low probably

mid-June or early July. after reviewing the Astrological aspects, although

it could be as late as August.

The following chart shows the 9 and 18 month cycles. The red

vertical lines show the

9-month cycle. Every 2nd line is the 18-month

cycle. Note that two cycles ago (the 18 month) was much deeper.

The blue line is a flag formation which is pointed to 2475.

The next 9 / 18 month cycle is is early August. If this is

marking a low nearby the market would have to turn down in the next few weeks

to be in a position to put in a trough in early August. The Primary cycle is

also due in early August.

Shorter term the following chart shows a 19 td cycle (blue

vertical lines). It is due again on July 15th along with a 24

harmonic (360 / 24) between the Earth and Saturn. I’m expecting at least a

short-term pullback.

The following chart shows the price line for the Earth and

Jupiter. The price line takes the longitude of the planet and converts it to

price. The Earth price line is green and the Jupiter price line blue. Note they

both have acted as support and resistance. Also, the markets often make sharp

move when the two price lines cross. I’m watching to see if 2450 holds. That’s

the price line for Jupiter.

The following chart of the SP500 includes the heliocentric

Bradley indicator (blue line). There are two possible change in trend dates are

June 13 and June 16.

I continue to watch the 24th

harmonic cycle (360 / 24) cycles for short term turns. The brown squares are

Sun / Saturn 15 degrees on the following daily chart.

The last hit was on May 31st, and then a move up.

The next hits are June 15th . Then June 29th which is on the 24 cd

cycle (blue). The latter could start a change in trend.

I have added 3 price lines to this

chart.

Saturn - black

Uranus - purple

These price lines can act as

support / resistance. Also on this chart are blue vertical line which is the 24 cd (calendar day) cycle. It has

been at highs and lows.

The date

of June 15th is the next 24 cd cycle.

May 12 was the day the general population became aware of the Cyberwar that's been going on for some time.

Note the references to May 12th above and the Mars waxing square to Neptune on

May 11th.

June 9th was a strange behavior in the US markets. The FANG stocks got slammed.

Fang's are Facebook, Amazon, Apple, Microsoft and Google (Alphabet).

I brought up the August 21 Solar Eclipse in the May

market letter. This should bring significant events in that time frame. In the

mean time, I will monitor transits that may hit the location of the Solar

Eclipse. An example in this blog is May

15th when the North Node transits over the point of the eclipse.

Gold

We put in a low in Gold on December 15th, 2016 which

was the 7.4-year cycle low in Gold

Gold appears to have put in a Primary cycle low on May 9th. which would put us

in the 5th week of a new Primary

cycle.

Gold most often starts a Primary cycle with a nominal 6 week

sub-cycle. Gold is currently 19 td’s along (4 weeks) and appears to be putting

in the nominal 6 week cycle crest. We should be going down to the nominal 6

week cycle trough over the next 1 to 2 weeks.

From last week’s blog post.

“Later in the week we

have the Sun / Neptune and Jupiter / Saturn both signatures for changes in

trend in Gold.”

“Later in the week there

is a weaker signature for Gold, Jupiter Direct. Aspect with a history of change

in trend for Gold. These are June 3, Venus conjunct Neptune and June 4th

Sun square Neptune.”

As mentioned many times we often get a pullback 2 to 3 weeks after starting a new Primary cycle.

After the Primary low is in (remember it is not confirmed)

I’m looking for precious metals to start moving up. Beyond technical’s and

Astrology, countries like China are reducing the rate at which they purchase US

treasuries. By June / July watch Gold increase. I am looking at precious metals being the potential trade of the year.

The “Trade of the Year” but there will be pullbacks.

The following chart shows a 27 cd (calendar day) cycle (blue vertical

lines)

The red lines headed up are the

Mars price line. Watch the Mars Price Line to see if it acts as support /

resistance and watch the 27cd cycle, next cycle June 16. We have a number of short

term cycles / Astros around the June 15 / 16 area.

The next chart is a longer term monthly

chart showing the 7.4 year cycle in Gold. They are the red vertical lines. Note

that the 7.4 year cycle put in a low in late 2015. We are now in a pull back

but we are very early in the 7.4 year cycle which should be bullish in the long

term.

Crude

We had May 5th as

the Primary cycle low. This puts us entering the 6th week of the new Primary cycle. Remember our rule. At

the start of a new Primary cycle we often

get a pullback 2 – 3 weeks along.

We appear to be getting strong support from the Planetary

averages (Jupiter through Pluto) around the 45.80 – 46.00 area.

There are a number of aspects involving Jupiter and Neptune,

the co-rulers of crude. There have also been aspects to Pluto which rules all

things from the ground.

Coming up in June we have Jupiter turning Direct (June 9th)

and Neptune turning retrograde (June 16) within 5 td’s of each other. Both are

co-rulers of crude.

The blue horizontal lines are the average longitudes of the planets Jupiter, Saturn, Uranus, Neptune and

Pluto converted to price. They should act as good support / resistance

areas

I'm watching

all aspects to Jupiter or Neptune,

the two rulers of crude. Crude can also be effected by Pluto as it rules

“things from the ground”. Pluto turned retrograde on

April 20th,

in the middle of the move down.

Following is a daily chart of crude

showing the price lines for the Sun

(green) and Pluto (black). Note that recent move down crashed through a

Pluto Price Line but now getting support at a lower Pluto Price Line.

Following is a chart (Sagittarius

Rising) of the USA in the inner wheel and the current time and date in the outer wheel.

There is a forming square which

will affect the affairs of the USA over the summer and fall months. This is the

square between transiting Saturn and natal Neptune.

The traditional influences are

illusion, delusion, confusion, lethargy and possibly depression. It is as if

everything has taken on a dull sheen. If you were a writer you would call it

the experience of the writer's block. Rather than force matters, take some time

to contemplate your life in a gentle, reflective light.

From a Mundane Astrology perspective,

it covers socialism, and left wing political ideas. It is associated with mods,

secret plots, fraud, swindling, bogus companies, loss and liquidation. This

same aspect was near exact during the election period. There are more cycles

building during July / August period. More on this in the next subscribers

report.

Shouldnt we hit a low around 16-19 then rally into June 30th and down after July 4th.Lot of crd and bradley turns June 30ish weekend

ReplyDeleteI'm looking at June 15,16 as a market turn or short term low. Remember the Bradley is an indicator for a change in trend. It does not indicate direction. We need to use other tools for direction.

ReplyDelete2nd quarter end on June 30th. Fund managers might wait to sell after that so that their performance will look good. Mahendra Sharma is forecasting that markets will start correcting or falling for sure after July 7th. Bond guru Gundlac also forecasted a summer correction to coincide with the fed interest rate hike in June. Summer is going to be interesting.

ReplyDelete