Summary

SP500. Volatility continues next week. There are not many meaningful

Astros next week. Late in the week, Dec

15th, Uranus semi-squares Neptune. This can mean someone or

something is checkmated. This could be a signature of a crisis or even a

revolution. These are slow moving planets and need a broad orb. +- 2 weeks.

We are entering the 6th

week of the Primary cycle which started on Oct. 29th. Price is now

below both the 15 and 45 day sma.

Review the daily chart of the

SP500 further down. Other things that can affect the markets are interest rates.

The FOMC announcement on Dec 19 is important as is their outlook on rates going

forward. Remember Jupiter is now in Sagittarius which may have an inflationary

effect. All things legal and the courts should start to have more of an effect.

I should say, starting Jan 2,

2019 Mars will cross 0 degrees of declination from South to North. Mars will be

more active than usual including planets that aspect Mars and I expect more violence

, war like activity or threats.

Gold is still under the effect of the Venus opposition to Uranus on Nov. 30 has a

strong history of moves in Gold. On the

Gold chart we have just put in the 3rd, 6 week low in the Primary

cycle. I’ll be looking for a Primary low late in 2018 or early 2019.

Crude's I was still

looking for a low in Crude around either Nov 24 where Neptune is Direct and watch,

Dec 5th the Sun is in waning square to Neptune. The Saudi’s are looking to cut back production while the US is increasing production from shale plays. Crude

looks like it could go higher here.

SP500

The last Primary cycle trough started

on June 28, 2018 and may have

completed it’s Primary cycle trough on Oct.

29, 2018. Please note, this is not definite and we could have a secondary

pull back so the Primary cycle trough is not firm yet. If price continues down

we could break lower than Oct 29th, putting into question if the

Primary Cycle started on Oct 29th.

If Oct 29th was the

Primary cycle low then we are beginning the

6th week of a new Primary and getting close to a 6 week low

which would be a trough.

We don’t want to see a close

below Oct 29 low or worse below the Feb 9th low We are still in a

period of volatile congestion.

The recent move down was timing

the 18-week Primary cycle and a 2 year cycle. The longer term cycles (2 year)

can distort the smaller term cycles (18 week).

September 21 seems to be the crest of the last Primary cycle and

may be the high for the

4 year cycle.

The following dates may have

significant moves or start a move. The following aspects are for a reverse in

trend or large range day. volatile week.

Dec 15 Uranus semi-square Neptune

Crisis,

revolution, suddenly incapacitated

Dates are a minimum +- 10 tds

unless otherwise noted. On longer timed aspects a time frame will be included.

Price is now below the 15 sma

and the 45 sma..

From last week, Gaps have been

filled

The following daily chart of the

SP500 is what we have been showing under the 24 Harmonic chart. This is the

basis of what we have been forecasting on.

Following is the 24 Harmonic

chart we have shown for many months.

The next hits are Jan. 2, 2019 and Feb 20, 2019. The

latter number is on the Uranus price line. Watch closely.

The 9 month cycle

The above chart shows the 9

month or 39 week cycle (blue vertical lines). It is due on early February 2019.

+- 10 td.s. The 20 week cycle was added as well (red vertical lines).

The next 40 week cycle is early February

2019.

From the last few posts:

“This coming year could see an

increase in geophysical activity, both earthquakes and volcanos.”

From late December through the

first Eclipse in Jan 6, 2019 watch for geophysical event.

See the link under

“Earthquakes”. This is an application from the USGS. There was a significant

earthquake in Alaska today.

There has been a number of

volcano’s erupting as well. Japan and Hawaii.

On a longer term basis the

following monthly chart of the DJIA

shows the 15 year cycle (red

vertical lines) and the 45 year cycle

(blue lines). The 15 year is due now

or took place April – June 2018. The 45

year due in Sept 2019. This is another example of a longer-term cycle

possibly distorting shorter term cycles. Bear in mind they need a broad orb.

The following daily chart of

the SP500 shows 2 Envelope channels. Red is the centered

20 week envelope channel.

Blue is the centered 40 week envelope channel. The dark blue squares are the

Sun / Neptune square which is often a short term change in trend.

We have had this noted it was

due for a sell. Also note the dark blue

squares. They are the dates of the Mars square Uranus transit.

We are entering the difficult time mentioned

over the last few months.

The red averages are based on the 20 week so

they are shifted 10 weeks or a ½ cycle.

I brought up Iran on the last

post. I’ll come back to those charts on any potential signs of conflict. It is

getting close. Watch the news for problems with Iran.

4 Year

Other longer-term aspects

like the 4 year cycle are coming

due. The SP500 4 year cycle should be due in mid to late 2019. The last 4 year cycle trough was Feb 8, 2016

The Primary cycle top on Sept 21, 2018 at 2490.91 may have

been the top for the 4 year cycle. This is not confirmed.

Other

Another very long term cycle,

the 90 year, is potentially around 2022 +- a lot. More time is needed to

confirm this cycle. The ½ cycle to the 90, the 45 year ties into the 90 and is

due in the same time frame.

Gold

Gold is 78 td (trading days) away from the

Primary cycle bottom on Aug 16, 2018. This could be near the end of the 3nd

6 week cycle. The Primary cycle is approx. 18 weeks long and we are at the16th

week. We should see a Primary cycle trough late in December or early January

2019. From this you can construct cycle charts.

The Primary cycle in Gold has been difficult to

ascertain. There was a Primary cycle trough on Dec 12, 2017 but determining the

next Primary trough has been very difficult.

We may have seen a low on Aug 16th but it must be confirmed. This was 4 trading

days after the Lunar Eclipse on Aug 11.

On occasion the Primary cycle can extend away

from it’s more normal 18 week length.

I’m looking for a crest in Gold probably during

December but Gold could go further up.

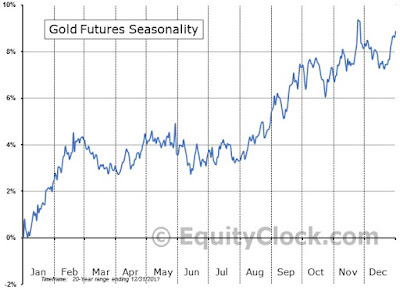

Seasonally Gold is usually flat over the early

summer months.

Price is now above the 15 sma and the 45 day sma.

The following chart shows two

daily envelope channels like the chart for the SP500 above. The blue squares

are the aspects duplicate the transits noted above.

The following chart shows a 27 cd (calendar day) cycle (blue

vertical lines). The last being Dec 3,

2018. The next is Dec 31st 2018

The Moon takes 27 days to orbit the Earth and the Sun

takes 27 days to revolve once at the

Sun’s equator.

The red lines headed up are the Mars price lines. Gold had been moving

sideways and have found both resistance and support at the Mars price line. The

darker red Mars lines are the main aspect. Moving below the red Mars price line

was bearish now we need to move above the red Mars price line as a positive

sign for a move up in Gold. Gold may follow the red, Mars price line up. Watch

closely.

The small blue x’s on the chart

show when heliocentric Mercury is in

Sagittarius. We often see changes in trend in Gold when Mercury exits

heliocentric Sagittarius.

Looking at this whole chart it

is based on a 24 harmonic. If you count each line from one darker red line to

the next you will find there are 15 of them. 15 * 24 degrees = 360 degrees.

The following chart shows when

Mars enters a new sign.(red squares). It often affects Gold. Mars is moving

into Aries on Dec 31. This is just about 18 weeks so we may see a Primary cycle

trough close to this date.

Crude

Oil put in a top on Oct. 3rd.

I’m looking at some longer term cycles and technicals to get a handle on future

direction.

Price is now lower than the Feb

5th, 2018 low of the Primary cycle. This can be very telling for crude. Watch

this for a possible bear market starting in crude.

June 18 was the date Neptune turned Retrograde and has been moving

backwards until November 24th

when Neptune turns Direct.

Watch the following dates for

Crude. There have been a number of aspects involving Jupiter and Neptune. Both

are co-rulers of crude.

My understanding is the Saudis

want to raise prices and the US is expanding it’s shale output, hoping to keep

prices lower.

This puts us at week number 23

realizing Nov 29 could have been the trough or the starting date of the Primary

cycle.

On the next chart note how price

often follows the Sun price line up (green line) and often stops and reverses

at the Sun price line or the Pluto price line (blue). We often get big range days. The red vertical lines are the 40 cd (calendar

day) lines. Crude price often bounce on a Pluto price line (blue) as well.

Watch the green Sun price line

and see if crude follows that price line up.

And finally, a weekly chart of

crude showing a 17 / 34 month cycle. Red vertical lines. The 17 month cycle

chart is shown below.

I would like to see a bounce starting around $2,600.

ReplyDeleteA move below $2,555 would be very negative and would negate a year end rally.

Do you expect new highs in first quarter 2019, also in Q3 OR Q4?

ReplyDeleteToo far out. I could make general comments at this point.

ReplyDeletecrash alert!

ReplyDelete